Introduction to Financial Ident Verification

Prerequisites

API Access

The nrich API uses HTTP Basic Authentication with two credentials:

- Client ID (username) and

- Client Secret (password)

Each set of credentials is associated with specific access scopes that define your permissions on the nrich platform. Contact us to obtain your dedicated credentials.

Postman Collections

We recommend downloading our Postman Collections to simplify your integration through our pre-configured API requests, allowing you to test endpoints instantly without any manual setup.

Getting Started

Before implementation, review our Widget Integration Guide for best practices and setup instructions.

Overview

The bank of your end-user already performed a thorough identification of the account ownership when opening the bank account. Our Financial Ident Verification allows you to make use of this valuable information the banks have on your users. By connecting and sharing the account information within your application, your end-user can immediately get to your core service offering without time-consuming identification processes like micro-deposits or manual provision of bank statements. Qwist has developed a comprehensive name-matching algorithm that compares the provided name of your end-user with the account holder name fetched from the end-user's account information.

Optionally, you can also combine the Financial Ident Verification with fetching the account transactions of your users.

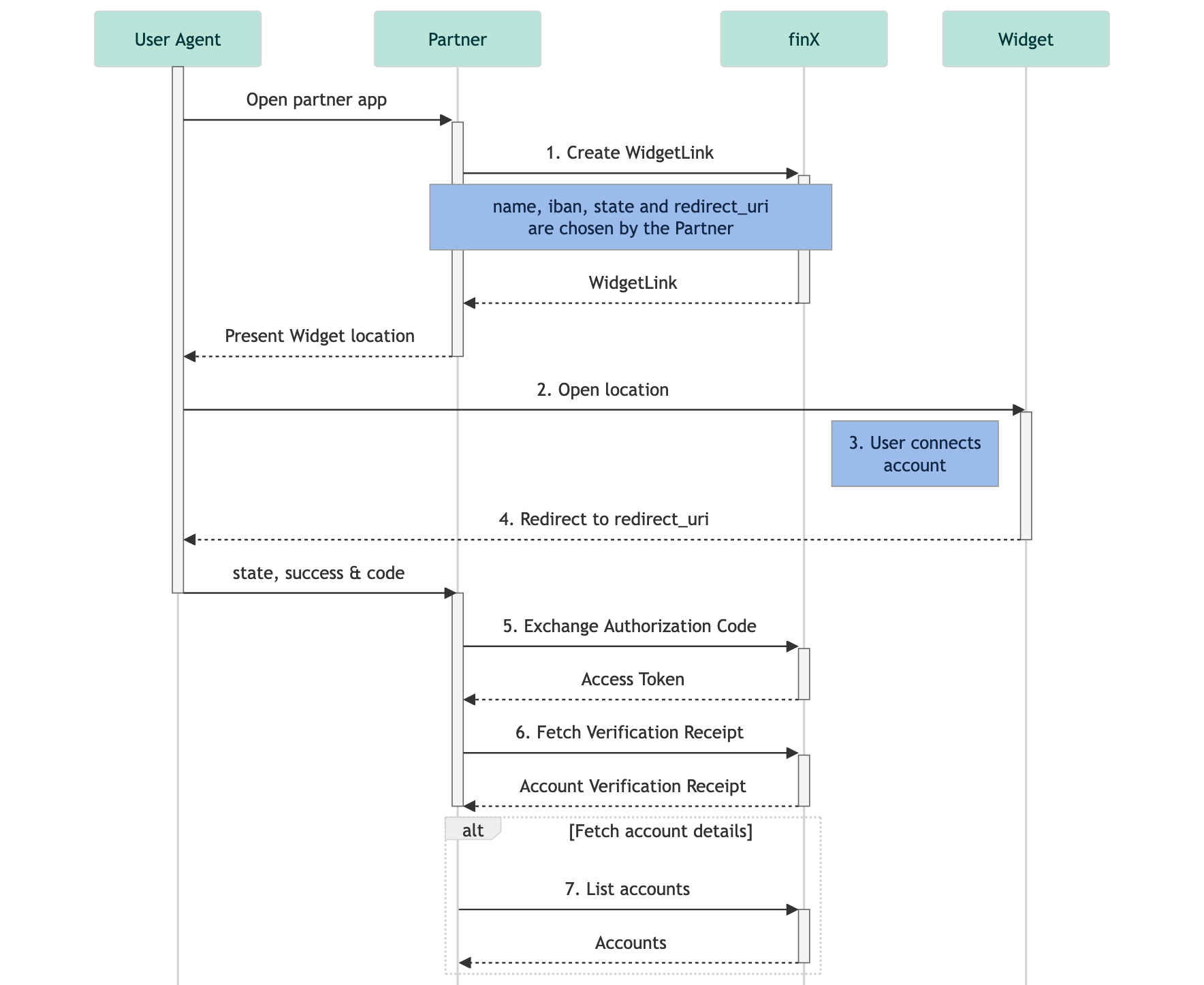

How it works

You can find a Step-by-Step description in the next section.

Updated 6 months ago