Introduction to Payments

Prerequisites

API Access

The nrich API uses HTTP Basic Authentication with two credentials:

- Client ID (username) and

- Client Secret (password)

Each set of credentials is associated with specific access scopes that define your permissions on the nrich platform. Contact us to obtain your dedicated credentials.

Postman Collections

We recommend downloading our Postman Collections to simplify your integration through our pre-configured API requests, allowing you to test endpoints instantly without any manual setup.

Getting Started

Before implementation, review our Widget Integration Guide for best practices and setup instructions.

Overview

The Payment Initiation product enables you to seamlessly integrate real-time access to an end user's bank account, facilitating rapid, secure payment initiations, and effectively eliminating traditional challenges.

Present your users with an effortless method to initiate a bank transfer, specifically Single Euro Payments Area (SEPA) Credit Transfers within the EU. This provides a stellar alternative to conventional online payments through credit or debit cards. Our Payment Initiation product comes with two primary capabilities tailored for varied use cases:

- One-time Payments: A single access payment model where the user's payment account is reached through the PSD2 API, with each transfer contingent on the end user's explicit consent and authentication.

- Ongoing Payments: This model facilitates the storage of creditor details and user account credentials, meaning end-users only need to authorize their payment with a TAN for succeeding payments from their bank accounts. This substantially trims down the steps involved for the user. Please note, that this should not be misconstrued with standing orders, which are currently outside our service scope.

Connectivity via the nrich API

The nrich API provides Payment services to over 2000 Financial Institutions. Here's a breakdown of the supported countries:

Supported Countries:

- Germany

- Italy

How it Works

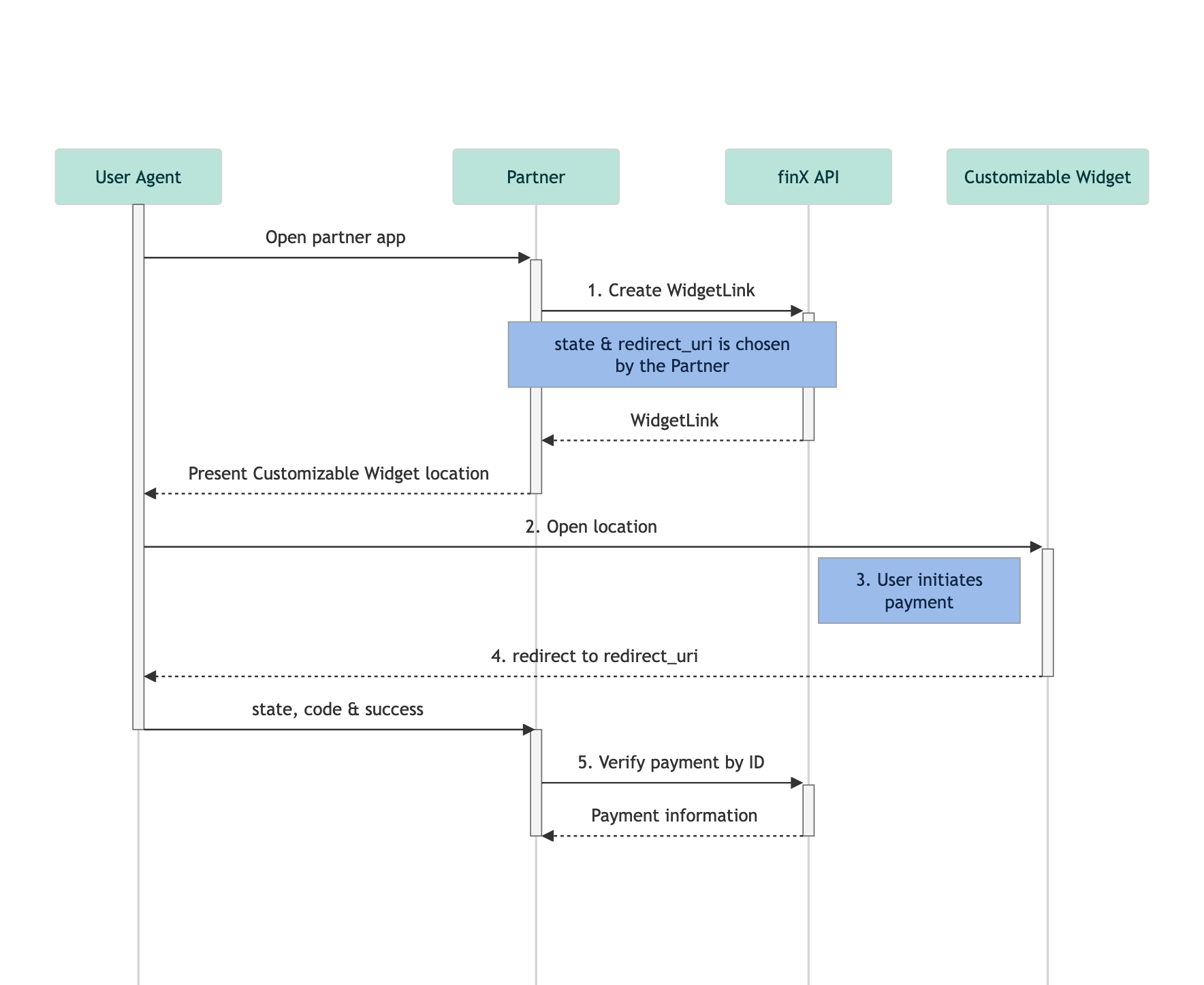

You can find a Step-by-Step guide depending on your use case in the following sections: Onetime Payments & Ongoing Payments.

Updated 6 months ago