Introduction to Disposable Income Verification

Prerequisites

API Access

The nrich API uses HTTP Basic Authentication with two credentials:

- Client ID (username) and

- Client Secret (password)

Each set of credentials is associated with specific access scopes that define your permissions on the nrich platform. Contact us to obtain your dedicated credentials.

Postman Collections

We recommend downloading our Postman Collections to simplify your integration through our pre-configured API requests, allowing you to test endpoints instantly without any manual setup.

Getting Started

Before implementation, review our Widget Integration Guide for best practices and setup instructions.

Overview

Disposable Income Verification emerges as a digital solution to assess user financials swiftly and securely. By providing real-time access to transaction histories, it streamlines affordability evaluations, offering insights into regular income streams and both fixed and variable expenses. This real-time data, further enhanced with categorized income and expenditure, gives you a transparent view of a user's financial health. Consequently, you can negate manual intervention, driving faster, informed, and data-backed decisions.

Terminology used:

- Income/Expense stream: Transactions grouped under the same category like salary payments from a company called Acme, Inc.

- Regular expenses: Expenses that occur on a predictable schedule such as monthly rent payments.

- Variable expenses: Expenses that do not have a set schedule, e.g., occasional movie tickets.

- Disposable income: The amount of money remaining after regular expenses.

- Discretionary income: Amount available after deducting both regular and variable expenses.

How it works

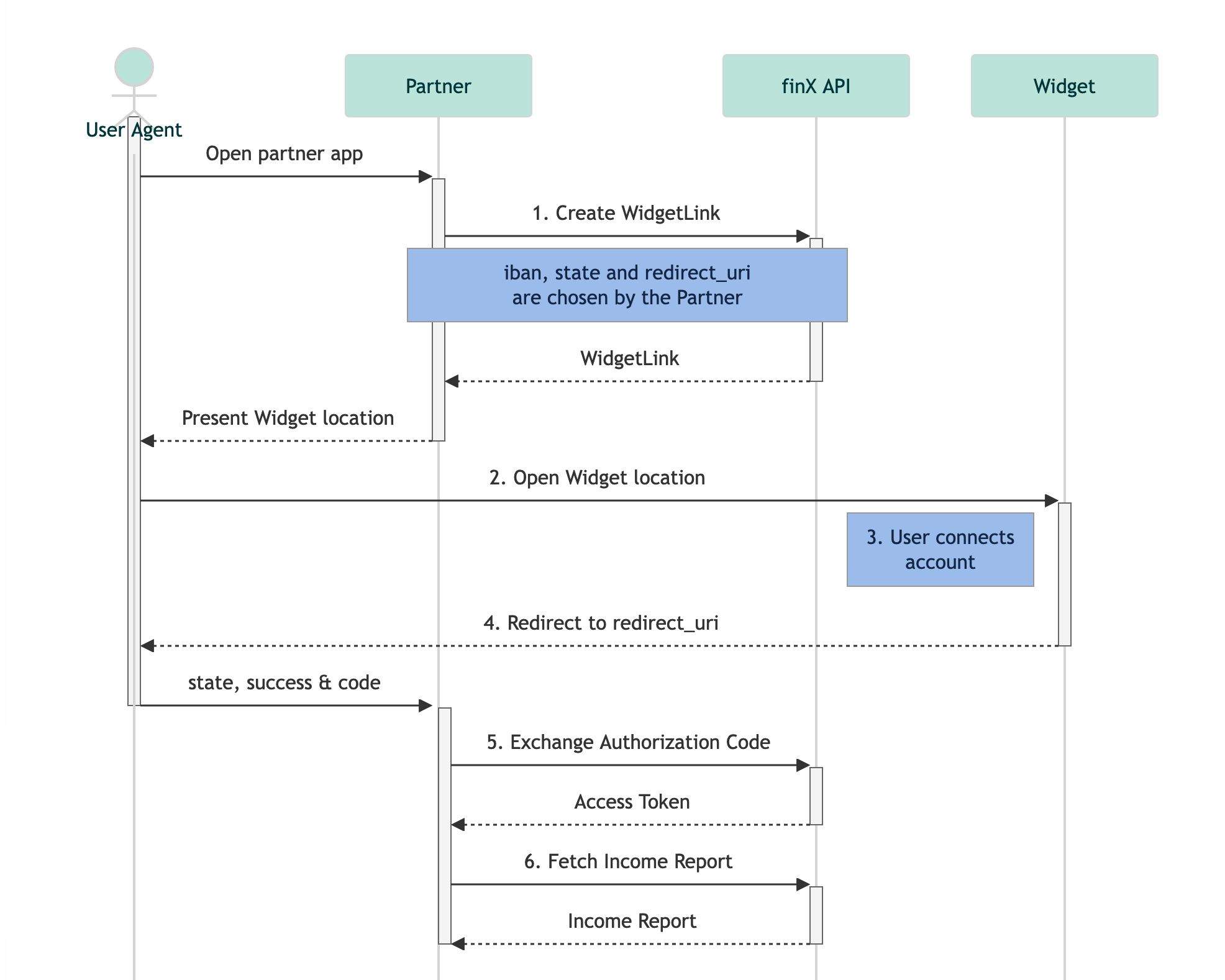

You can find a Step-by-Step description in the next section.

Updated 6 months ago